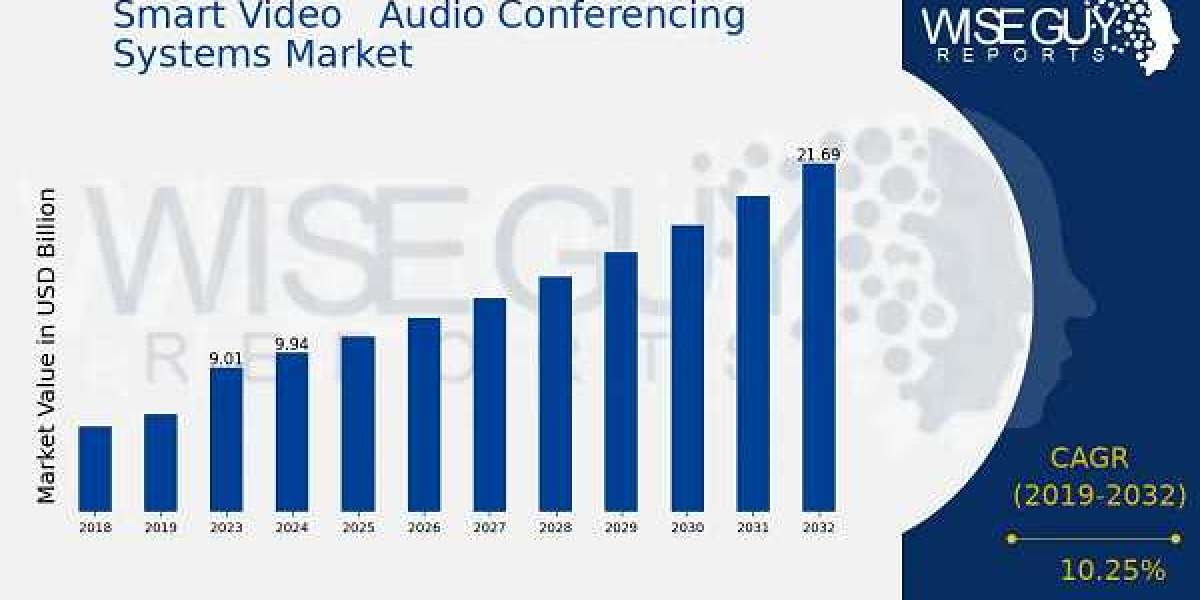

A comprehensive Smart Video Audio Conferencing Systems Market Share Analysis reveals a dynamic and highly competitive landscape where market share is contested by a diverse mix of hardware specialists, software giants, and traditional AV integrators. The market leadership is currently fragmented and depends heavily on the specific product category and room size. In the hardware endpoint market, players like Logitech, Poly (now part of HP), and Cisco have historically commanded significant market share. Logitech has been particularly successful in capturing a large share of the small-to-medium room segment with its user-friendly and cost-effective video bars. Poly and Cisco, with their deep enterprise heritage, maintain a strong foothold in the market for large, integrated boardroom solutions. As detailed in market share breakdowns featured in reports from firms like Wise Guy Reports, the battle for market share is increasingly being fought not on hardware specifications alone, but on the strength of a vendor's ecosystem and its certification and partnership with the leading software platforms.

The competitive landscape is fundamentally shaped by the immense market power of the software platform providers, primarily Microsoft (with Teams) and Zoom. These companies do not directly lead in hardware sales, but they exert enormous influence over the market by controlling the software ecosystem. They have created hardware certification programs that dictate which devices offer the best, most integrated user experience on their platforms. This has created a dynamic where hardware vendors must align their product roadmaps closely with Microsoft and Zoom to gain access to their massive customer bases, effectively making certification a prerequisite for capturing significant market share. This has also led to the rise of companies like Yealink and Neat, who have gained substantial market share by focusing their strategy on building devices that are deeply integrated and co-developed with a specific software partner, offering a seamless, appliance-like experience that is highly attractive to IT departments seeking simplicity and reliability.

The future evolution of market share will be defined by the battle for the platform, the rise of new entrants, and strategic mergers and acquisitions. The software giants are in a prime position to increase their influence, potentially even by releasing more of their own branded hardware (like Google's Series One room kits) to create a tightly controlled, Apple-like ecosystem. This could erode the market share of traditional hardware-only vendors. At the same time, new entrants with strong expertise in AI and computer vision may emerge, challenging incumbents with more advanced intelligent features. We can also expect continued MA activity, such as HP's acquisition of Poly, as large IT companies seek to build a comprehensive portfolio of hybrid work solutions that combines personal computing with room collaboration, a strategy that could significantly reshape future market share distributions. The ability to offer a complete, end-to-end solution for every type of workspace, from the home office to the boardroom, will be the key to winning market share in the future.